Bitcoin's Risk and Return Explained in 7 Amazing Charts (That You've Never Seen Before) | by Stephen Foerster | Medium

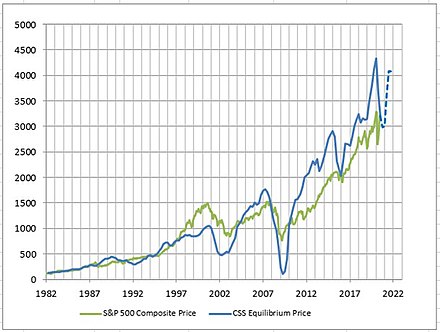

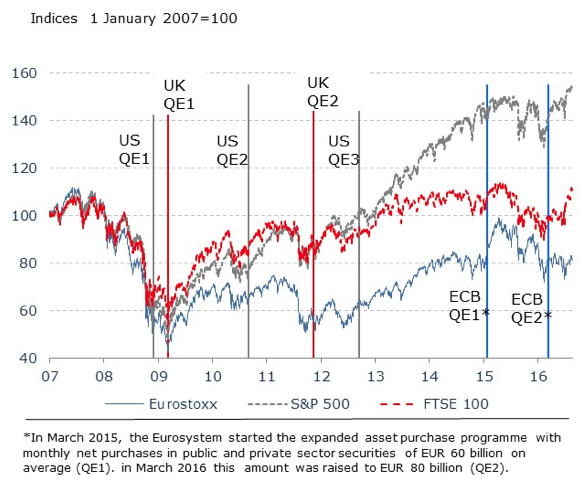

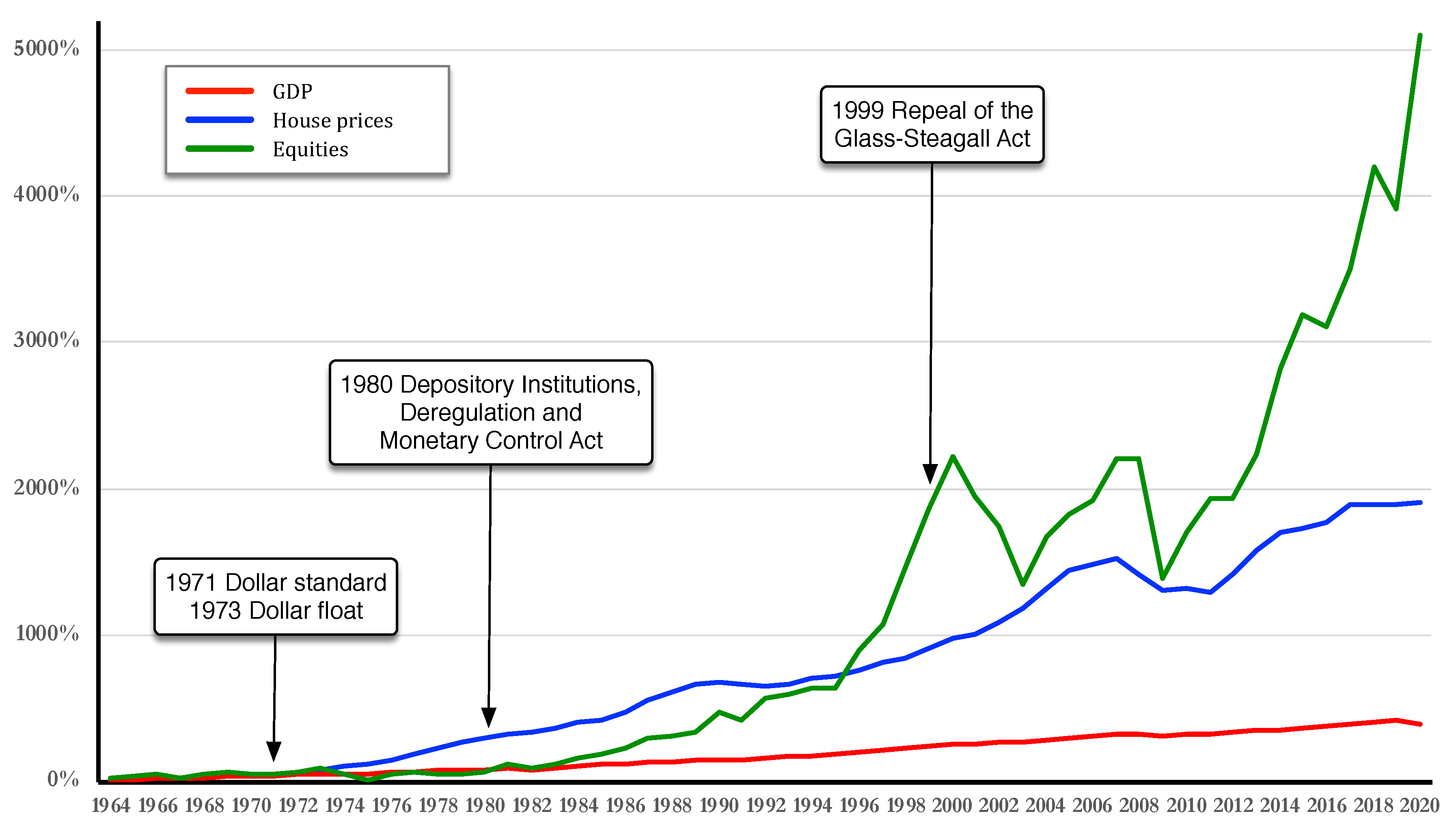

JRFM | Free Full-Text | Crisis and the Role of Money in the Real and Financial Economies—An Innovative Approach to Monetary Stimulus | HTML

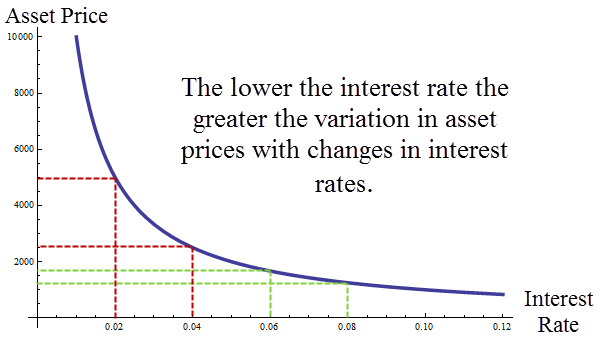

/dotdash_Final_Inverse_Correlation_Dec_2020-01-c2d7558887344f5596e19a81f5323eae.jpg)

/Interest-Rates-and-Asset-Prices-56a093873df78cafdaa2da15.jpg)